Importance of Understanding Personal Finance

One of the things which formal education seems to never effectively teach you about is understanding personal finance and its importance in financial independence. In this post I’ll try to break down the most simple concepts which everyone should know about.

Why SHOULD we care about personal finance?

Because as we grow up, we should be aiming for financial independence. There are a couple of levels of independence, but what I mean is that, we should reach a point in our lives where we won’t need to depend on anyone else for financial support and we are able to bear the cost of living through our own means without the reliance of anyone else (parents / relatives / siblings / significant others / or even an employer).

You might ask yourself , “So how is this possible?”. Well the comes from the type of income you are earning:

- Non-passive income – You have to WORK FOR THE INCOME, and the income is dependent on the amount of hours / days /weeks / months / years you work. So this income comes from full time / part time / casual / contract based work where you are paid a salary or a wage.

- Passive income – Income that is generated through ASSETS that WORKS FOR YOU. The cost of the asset is the initial investment, and any costs related to maintenance. There are physical assets such as property or a business you own (but not necessary run). Financial assets such as bank deposits, bonds, shares, and index funds. And finally there are non-tangible assets, such as intellectual property.

So the goal here is to work for non-passive income, in order to invest in assets that will generate passive income. Therefore as you accumulate more passive income, you may be able to work less yourself as your assets work for you, giving you the option to spend more time doing things you want to do (leisure, passion projects, travel etc) and less time on worrying about earning non-passive income in order to cover all your expenses and the cost of living. A book I would highly recommend is “Rich Dad, Poor Dad” (Amazon Link) written by Robert Kiyosaki. An example in terms of thinking about income can be seen in the following paraphrased story:

So the goal here is to work for non-passive income, in order to invest in assets that will generate passive income. Therefore as you accumulate more passive income, you may be able to work less yourself as your assets work for you, giving you the option to spend more time doing things you want to do (leisure, passion projects, travel etc) and less time on worrying about earning non-passive income in order to cover all your expenses and the cost of living. A book I would highly recommend is “Rich Dad, Poor Dad” (Amazon Link) written by Robert Kiyosaki. An example in terms of thinking about income can be seen in the following paraphrased story:

A son has been saving up from his pocket money and after school job to buy a car and asked his dad to give him some advice on what kind of car he should buy. The dad tells his son, instead of buying the car NOW, which also comes with maintenance costs of petrol and servicing, he should use that money as well as his future savings and invest it in the stock market so that if he does well and makes the right informed decisions, the investment would be able to generate enough passive income to for the son to buy a nice car EVERY YEAR.

This is the second idea behind becoming ‘financially’ independent. That all your expenses can eventually be covered through passive income opening up more possibilities for how you are able to spend your time. There is a lot to talk about in detail, but this post is more about the general overview and helping you get in the frame of mind.

So where should you start?

The best way to start is to do 2 things:

- Monitor your spending

- Make the most of the assets you have RIGHT now

Monitoring your spending

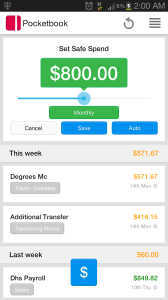

There is an amazing service that’s pretty new to Australia which I would highly recommend used to monitor your spending. It recently recently release it’s Android App, whilst already catering for iPhone users as well as a web portal you’re able to access. The service is called Pocketbook (similar to Mint.com for US locals) and what it does is it links all your bank accounts / credit cards and automatically gathers all the information in terms of spending and income in a beautifully presented way in one place, where you are able to track and label all your accounts and transactions.

There is an amazing service that’s pretty new to Australia which I would highly recommend used to monitor your spending. It recently recently release it’s Android App, whilst already catering for iPhone users as well as a web portal you’re able to access. The service is called Pocketbook (similar to Mint.com for US locals) and what it does is it links all your bank accounts / credit cards and automatically gathers all the information in terms of spending and income in a beautifully presented way in one place, where you are able to track and label all your accounts and transactions.

Also because it is a READ ONLY service, you won’t be able to make any transactions through the service (you’ll still need to log into your online banking services), which I’m kind of glad of because I don’t need to worry as much about security and what happens if someone manages to get into my Pocketbook account. (Pro tip: to put in cash transactions make sure you label cash withdrawals as ‘Transferring Money’ and then you are able to manually enter in each cash transaction so you don’t double up on same the item).

However if you prefer your information not to be stored in the cloud and would rather input all transaction manually, I would firstly suggest to ask for receipts for EVERYTHING you purchase (where possible) so that you have a record of it (sometimes, it’s just not convenient to put in information on the spot). Second of all, I would recommend the money tracking app MoneyWise (for Android – there is also a Paid Version) and for iPhone users you can check out this page.

Understanding how you spend your money allows you to find areas where you can cut down on expenses as well as set achievable budgets and create saving goals.

Finally, credit cards are great to have, but I would strongly recommend to only spend what you can pay back RIGHT NOW. Otherwise, debts will begin to accumulate and this will develop into a bad habit of overspending.

Making the most of your current assets

Questions you can ask yourself and then take action upon:

- What is the interest rate for my savings account?

- Are there other banks that are offering better interest rates?

- What are the conditions and eligibility of earning the maximum interest rate?

- Do I have a saving account that I can access immediately in case of a rainy day? (SUPER IMPORTANT: Usually the common goal is to have this savings account able to cover the cost of living for 6 – 12 months) Once you’ve reach this savings goal, NEVER touch the money unless it is for a rainy day.

- Do I have multiple superannuation accounts? (If yes, put them all into one account ASAP)

- Where else can I put my money to earn the best possible return?

- How can leverage my skills and expertise to gain more income i.e. got a spare bedroom? Air BnB. Got some spare time? Freelancer / ODesk / Airtasker

- How come I promote myself to gain credibility and higher qualifications(and therefore get paid more)?

There are many more hints and tips out there. If you have any personal finance rules that you strongly believe in let me know in the comments below.